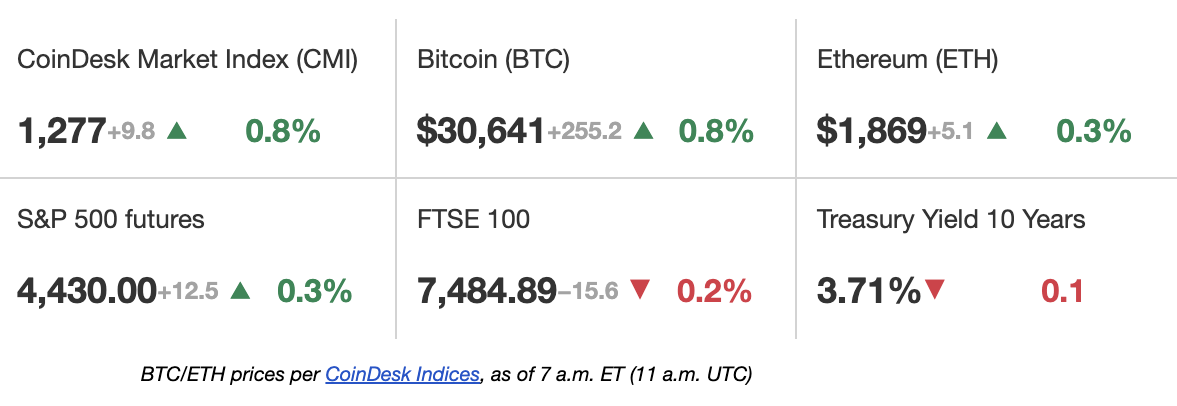

Latest Prices

Top Stories

In its first legal response to the U.S. Securities and Exchange Commission’s (SEC) lawsuit, crypto exchange Coinbase (COIN) claimed that digital assets listed on its platform fall outside the regulator’s (SEC) purview. The SEC sued Coinbase at the beginning of June, alleging that a dozen of the cryptocurrencies offered through its wallet or trading platforms were unregistered securities. In its answer, filed early Thursday, Coinbase claimed that these cryptos are not investment contracts and therefore not securities. It’s an argument Coinbase has advanced before in public statements, but Thursday’s filing goes into further detail explaining the company’s position: cryptos on the exchange’s secondary market platform are not part of any arrangements where a promoter is selling an asset tied to a contract, said the company, referring to language in the Supreme Court’s precedent-setting Howey case.

Germany’s financial watchdog has decided not to grant crypto exchange Binance a custody license, news publication Finance Forward reported on Thursday. The report added that it’s unclear if the denial was a formal decision from the Federal Financial Supervisory Authority (BaFin) or an intention expressed in ongoing discussions. “While we are unable to share details of conversations with regulators, we continue to work to comply with BaFin‘s requirements,” a Binance spokesperson said in an emailed statement to CoinDesk. “As expected, this is a detailed and ongoing process,” the spokesperson continued. “We are confident that we have the right team and measures in place to continue our discussions with regulators in Germany.”

The native token of decentralized finance (DeFi) protocol Compound (COMP) has surged by more than 50% over the past four days alongside a spike in volume and outflows on Binance. COMP was trading at $45.98 at press time, higher by 51.4% since Sunday and doubling in value from its June 10 low of $22.89, according to TradingView. Lookonchain noted that one particular wallet deposited $3.5 million worth of tether (USDT) to Binance on June 26 before withdrawing 50,000 COMP tokens ($2.26 million) on Wednesday and an additional 120,000 tokens ($5.5 million) on Thursday. COMP is one of a number of altcoins that have been rallying along with bitcoin’s charge back above the $30,000 level. The likes of Blur and Arbitrum posted double-digital gains earlier this week, indicating a positive shift in sentiment after three-months of low volatility trading at range lows.

This article is referred from Coindesk.com