Most cryptocurrencies traded higher on Friday after a volatile week.

Equities were also higher on Friday, while gold, a traditional safe haven asset, traded lower. The rebound in stocks and the outperformance of several alternative cryptocurrencies (altcoins) suggests a greater appetite for risk among investors.

But there is still the potential for greater price swings in the near term. “Despite the risk-on week for crypto assets, we will likely encounter additional volatility in the near term. We remain optimistic that any dips for ETH and BTC are buying opportunities,” Sean Farrell, vice president of digital asset strategy at FundStrat, wrote in a Friday email.

Latest prices

●Bitcoin (BTC): $42,243, +2.83%

●Ether (ETH): $2,981, +4.80%

●S&P 500 daily close: $4,463, +1.17%

●Gold: $1,920 per troy ounce, −1.16%

●Ten-year Treasury yield daily close: 2.15%

Bitcoin’s trading volume across exchanges continued to decline after the spike on Wednesday. Further, the volume of buy orders versus sell orders in the futures market was balanced on Friday, which could mean the current upswing in price lacks conviction.

The average funding rate, or the cost of holding long BTC positions in the perpetual futures listed on major exchanges in the perpetual swaps market, ticked higher, possibly reflecting bullish sentiment.

In other news, the Bored Ape Yacht Club-linked ApeCoin (APE) was up 90% on its second day of trading, rebounding to over $15 after lows of $6.48 on Thursday. That’s a strong rebound from an 80% decline on Thursday.

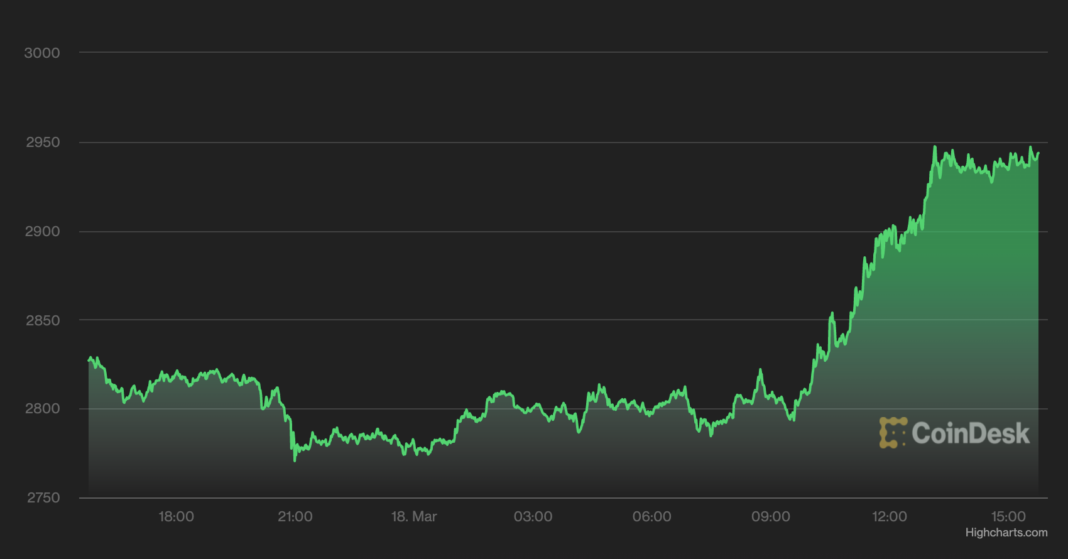

Ether bounces on merge progress

Ether’s rise is partly due to progress on the merge of the Ethereum blockchain’s mainnet with the Beacon Chain.

Earlier this week, Ethereum merged on the Kiln testnet ahead of the blockchain’s eventual move to a proof-of-stake network, with network validators now producing post-merge blocks containing transactions, CoinDesk’s Shaurya Malwa wrote (read more here).

“We have seen a corresponding increase in the number of active validators on the Beacon Chain from 300,702 at the end of February to 315,576 as of March 17. That’s a 4.9% increase in just 17 days compared to 3.9% during the full month of February or 4.8% during the full month of January,” David Duong, head of institutional research at Coinbase, wrote in a Friday newsletter.

From a technical perspective, the rise in ether has outpaced bitcoin, which could see further upside over the short term. The ETH/BTC price ratio held support at 0.064 and faces resistance at 0.073, which is roughly 4% away.

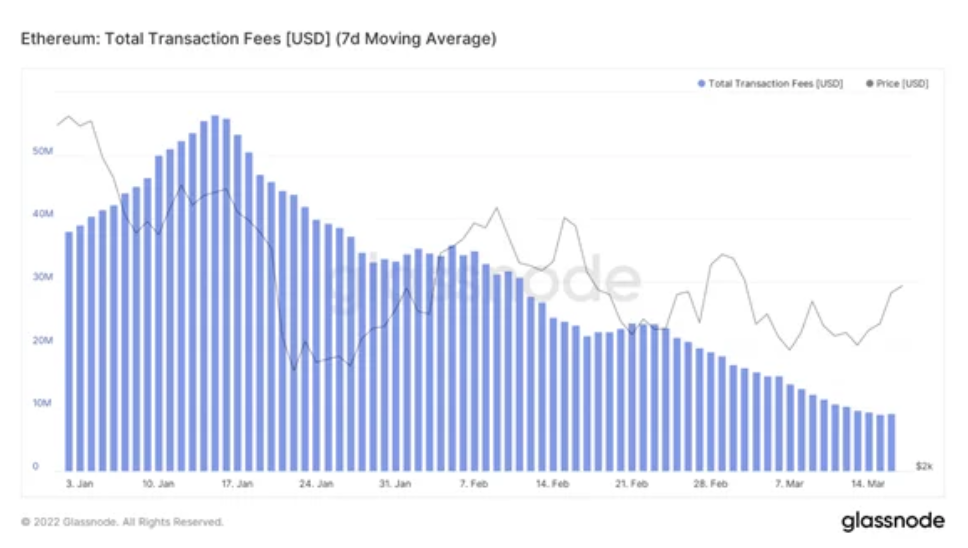

On the flip side, analysts also noticed slowing activity on the Ethereum network.

The chart below shows the recent decline in total transaction fees on the Ethereum blockchain, which means miners are paid less.

One reason behind the slowdown is a reduction in demand for expensive non-fungible tokens (NFTs), which are predominantly minted and traded on the Ethereum network, according to FundStrat’s Farrell, who also noted that Google search interest for NFTs peaked in mid-January.

Farrell also highlighted a sharp rise in ETH’s a price-to-sales multiple, which is now above 50 compared with 17 a few months ago – a significant jump that could signal a frothy market.

Altcoin roundup

-

ApeCoin Rebound: The ApeCoin’s surge on Friday gives the token a $3.8 billion market cap, making it the 33rd-largest coin, according to CoinMarketCap. CoinGecko lists it at 66th with a market cap of $1.7 billion. Read more here.

-

DeFi ‘Super App’: Polkadot-based lending protocol Parallel Finance is trying to become a one-stop shop for all corners of decentralized finance (DeFi). That effort accelerated Friday with the initial launch of six products spanning the DeFi spectrum from wallets to staking. “Overall, we’re building a ’super app,’ an end-to-end DeFi platform for Polkadot to start,” founder Yubo Ruan told CoinDesk in an interview. Read more from CoinDesk’s Danny Nelson, here.

-

Altcoin volume update: “BTC continues to be the dominant asset traded by our consumer client base,” Coinbase wrote in a newsletter. BTC volumes represent an overwhelming 32.1% of volumes traded, although large market cap tokens such as AVAX, SOL, LUNA and ADA have seen a pickup in trading activity following price increases. Coinbase also noticed some hedge funds buying into the recent price bounce, while others used the opportunity to reduce risk.