Several on-chain positions are at risk of being liquidated following ether’s (ETH) plunge to a two-month low of $1,373.

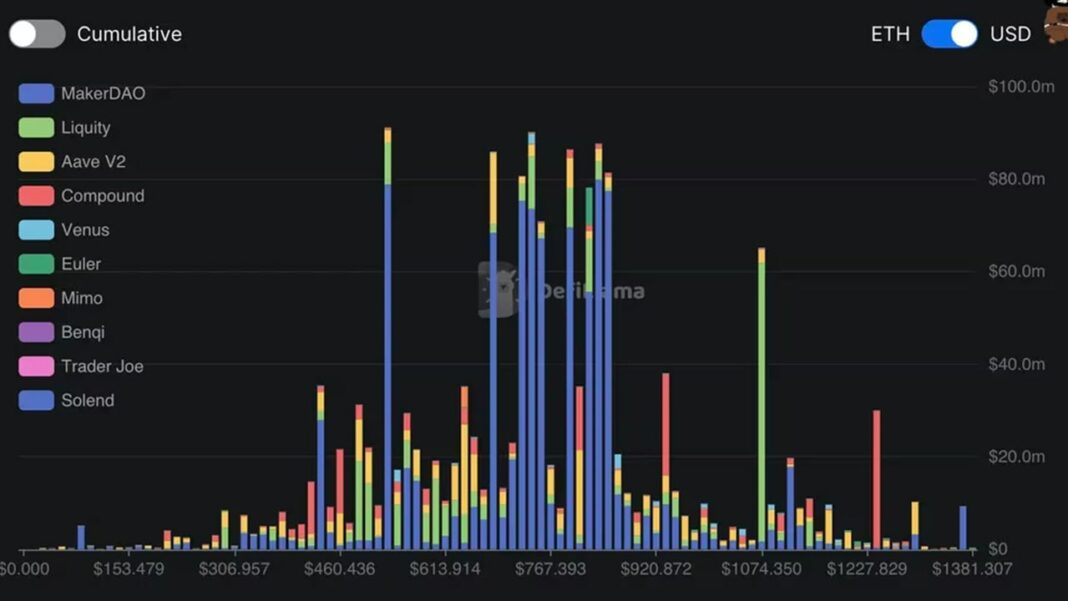

A $9.2 million position on MakerDAO will get liquidated at $1,367, while a $29.6 million position on decentralized-finance (DeFi) lender Compound will get liquidated by the protocol’s smart contract at $1,241, according to DefiLlama data.

On-chain liquidations occur when the value of collateral added by a user borrowing an asset slumps, and the user is then required to add more margin to avoid the collateral being liquidated. Conversely, the user will also risk liquidation if the value of the borrowed asset rises beyond borrowing capacity.

On decentralized exchanges and lending protocols, meanwhile, a total of $119.3 million is at risk of liquidation if the price of ether slumps by another 20%.

Ether is trading 18% lower than its February high of $1,745 and 71% lower than its record high of $4,876 in November 2021.

A slide in stocks, coupled with a regulatory clampdown on crypto, has sent the price of crypto assets spiraling. Bitcoin was down by 7.4% in the past 24 hours, trading at $20,050, according to CoinDesk data, as fears that the down market will continue intensify.