The Market Wrap team is out of the office on Friday because it’s a CoinDesk company holiday, with most traditional markets closed in the U.S.

Even so, we worked in advance to put together some reading for the long weekend, including:

-

Technical insight on bitcoin based on a one-week timeline for a longer-term view of how the charts are looking.

-

An exploration by CoinDesk’s Angelique Chen of a new claim against OpenSea, amid uncertainty over the NFT trading platform’s reimbursement policy.

In the meantime, please sign up for our daily Market Wrap newsletter explaining what happens in crypto markets – and why.

Technical insight

Bitcoin Neutral, Support at $37K and Resistance at $46K

Bitcoin’s weekly chart shows support/resistance. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) wavered this week, showing uncertainty among market participants.

Most technical indicators are neutral, although short-term buyers could remain active between the $35,000-$37,000 support zone, similar to what occurred earlier this year.

Momentum signals, according to the MACD (moving average convergence divergence) indicator, are positive on the weekly chart and negative on the monthly chart. That suggests a period of range-bound price action could persist, albeit with an average price swing of 20%.

On the weekly chart, the 100-week moving average, now at $35,388, is an important gauge of trend support. Buyers will need to keep BTC above that level in order to sustain a recovery.

Still, there is strong resistance at the 40-week moving average of $46,800.

An upside target of $50,966 was within close distance on March 28, but the price pulled back, like it did last September.

For now, bullish countertrend signals will need to be confirmed with weekly price closes above $40,000.

NFT slowdown emanating from hacks

OpenSea, the leading NFT marketplace, has faced several lawsuits following hacks on its platform. Jimmy McKimmy, an NFT owner from Texas, sued OpenSea for the recovery of more than a $1 million loss of his stolen NFT, Bored Ape #3475.

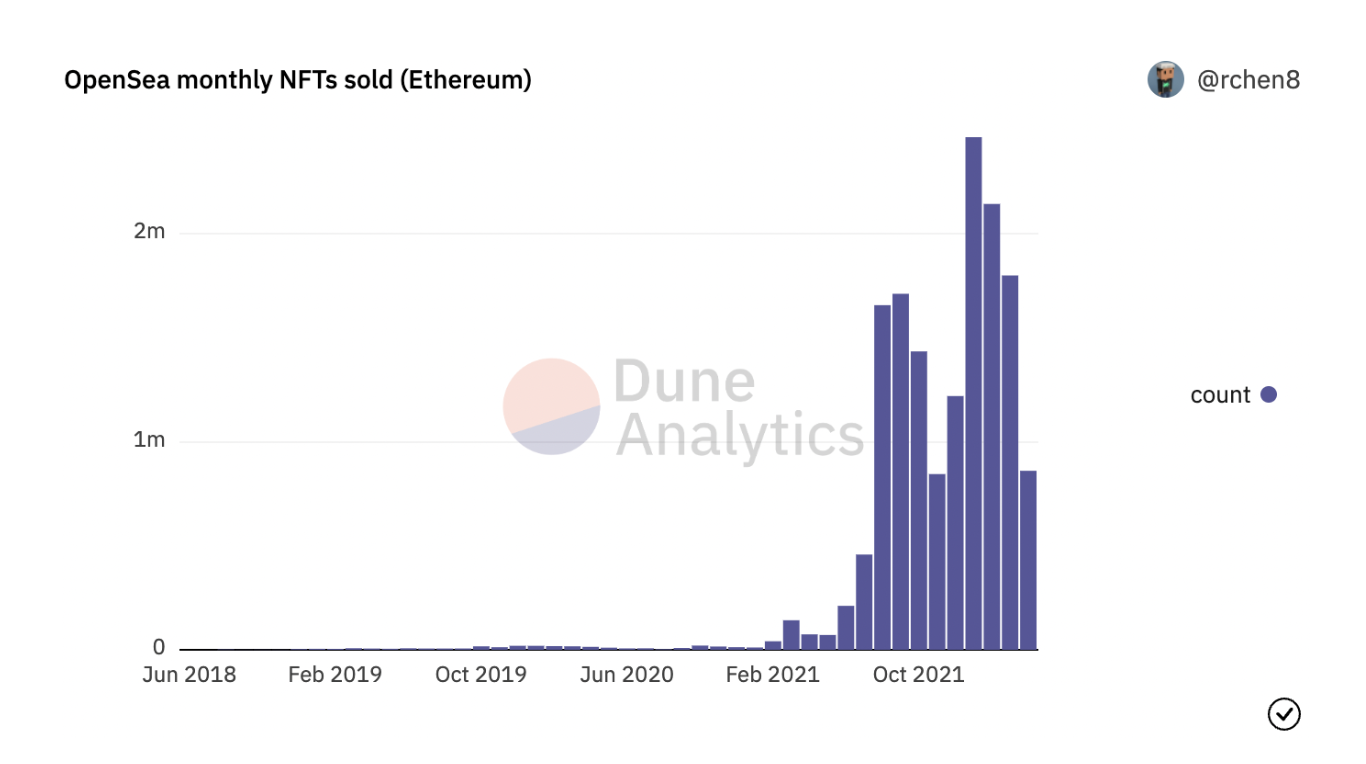

Hacks have led to more uncertainty in the NFT community, which could be the source of slowing demand in recent months.

McKimmy is not alone with his hefty loss. OpenSea recently issued around $1.8 million in refunds to users whose NFTs were stolen. Still, OpenSea’s policy on such reimbursements is unclear at the moment. The platform requires users to connect their accounts to a wallet, which means others can see unlisted NFTs and make potential offers for those assets. In McKimmy’s case, the hacker made an offer, hacked the code, accepted the offer for McKimmy and then resold the NFT.

Earlier this month, OpenSea’s Discord account was hacked and posted a phishing link disguised as a “stealth NFT mint” and was used to steal the NFT Mutant Ape Yacht Club #8662 from a user. Similar incidents kindled comments on Twitter and caused a slowdown of NFT trades overall.

The number of NFTs sold on OpenSea by month (Dune Analytics)

Altcoin roundup

This week’s winners (through Thursday)

-

SHIB and DOGE: Popular dog-themed meme coins SHIB and DOGE rallied by as much as 20% over the past 30 days. The rise in prices mostly followed the broader crypto recovery that was led by alternative cryptos, indicating a greater appetite for risk among traders. Also, earlier this month, Tesla (TSLA) CEO Elon Musk said he is not selling his crypto holdings, which included DOGE.

This week’s losers (through Thursday)

-

WAVES and LUNA: 20% price drops in WAVES and LUNA detracted from broader crypto market gains over the past week. Waves is a layer 1, or base, smart-contract blockchain, whose founder recently blamed short sellers for the WAVES token sell-off, although the project has been plagued with chaos. And Terra’s LUNA token declined, even though the Luna Foundation Guard has been busy accumulating BTC for its reserves.

News Insight

Bitcoin’s mining pool concentration

A handful of mining pools control too much hashrate (computational power used to mine and process transactions on a blockchain), which could pose a threat to bitcoin’s decentralization, according to CoinDesk’s Aoyon Ashraf.

“Mining pools are, by definition, a centralizing force in the bitcoin mining ecosystem,” Jurica Bulovic, head of mining pool Foundry, said. “They provide a service of aggregating hashrate from individual miners in order to minimize the inherent revenue volatility, and provide stable payouts.” Foundry is owned by Digital Currency Group, which is also CoinDesk’s parent company.

Read more: What are Bitcoin Mining Pools?

Foundry USA is the largest bitcoin pool in the world, with almost 20% of the total network’s hashrate, according to BTC.com data as of March 25.

That concentration may seem like another threat to the decentralization thesis. Mining pools, however, don’t control the network and don’t have a lot of clout, because any miner can quickly change pools if there is any hint of foul play, such as censoring bitcoin transactions, Bulovic said. Read the full analysis here.